702-493-7516

10am - 5pm

Pacific Standard Time

International Business Funding.us

Commercial Financing

Commercial Real Estate Hard Money Lending

International Business Funding arranges financing for short-term equity and asset-based loans. We specialize in lending to income-producing properties. Our aim is to provide the most competitive services and terms to our clients in the most efficient manner possible. The investors associated with International Business Funding have established a unique skill-set used to find creative solutions in funding the most challenging of transactions.

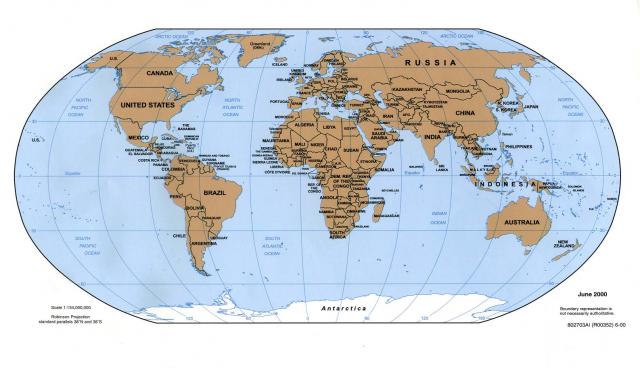

We, and our affiliates, will structure, close, and fund first mortgage loans for commercial properties. Our funds are available for acquisition, refinancing, turnaround / work-out situations, foreclosures, bankruptcies and land development. We will also consider situations involving joint venture opportunities and participation loans with other lenders. We will consider funding opportunities in the United States, Canada, Central and South America, Caribbean, Europe, and some parts of Africa and Asia.

Office

International Business Funding can provide short-term bridge financing for office buildings as well. The office market provides diverse opportunities for investors, owners and developers. We can deliver quick funding solutions for new acquisitions or refinances. Whether it is a leasing issue, a need for significant tenant improvements, or a complicated ground lease, we can work through the issues and help you take advantage of the unique opportunities in the office financing market. We can provide the capital resources that help borrowers maximize the potential of new or existing properties in the office building market place. Our investors have many combined years of experience in funding office buildings for commercial real estate and the commercial lending businesses. International Business Funding has the knowledge and expertise to quickly determine the real value of proposed and existing commercial properties.

Retail

International Business Funding has the ability to secure financing for retail real estate. Repositioning and re-tenanting is critical to the success of any retail center. From the purchase and renovation of strip centers and regional malls to super-regional malls and lifestyle centers, International Business Funding has cultivated strong working relationships with a broad range of lenders who understand the nuances and needs of the retail real estate industry. With our track record and strong relationships within the lending community, International Business Funding can offer first mortgages or refinancing for retail properties with maximum diversity in terms, rates and lending sources.

Hotel

International Business Funding has the ability to close a hotel loan fast, often an important factor for many borrowers. Our company enables its borrowers to maximize opportunities ranging from fast closings when time is of the essence, to lender or partner non-performance, and to other special situations in which prompt funding is required. In the hospitality industry, each transaction is unique and requires extensive creativity and knowledge of the industry. At International Business Funding, we specialize in the arrangement of short-term financing for virtually every hospitality transaction imaginable. Our team of highly dedicated associates is highly experienced in structuring all types of hotel projects, including new construction, mixed-use developments, renovations, re-branding, conversions and resorts.